Mark N. Harris & Hervé Le Bihan & Patrick Sevestre, 2020, Journal of Money, Credit and Banking, vol. 52 (2–3)

RESEARCH PROGRAM

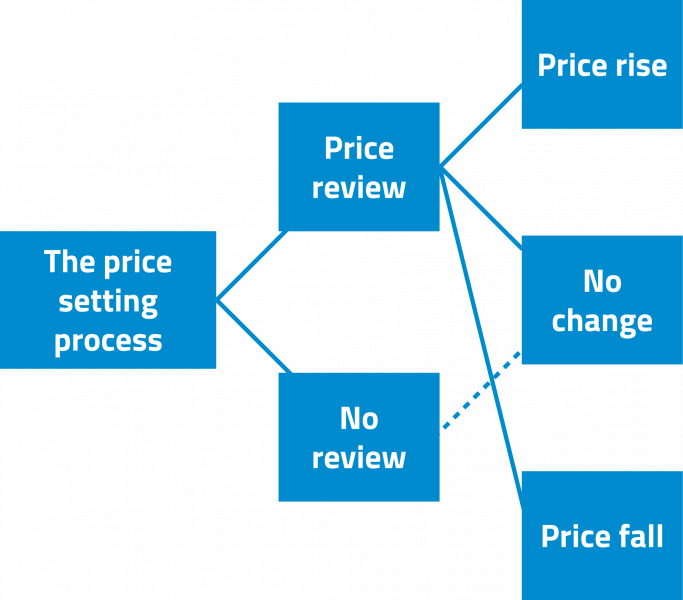

Since the second half of the 1990s, there has been a spectacular growth in research on the characteristics of price rigidity observed at the firm/outlet level, as well as on its causes and consequences. While price rigidity was initially seen as essentially a consequence of menu costs (changing prices is costly for firms), a competing, though complementary, explanation of price rigidity emerged: firms do not continuously review their prices. Before (potentially) implementing price changes, firms and outlets commonly perform a price review to decide on the wisdom and the extent of the price change Because the process requires collecting and processing information, price reviews are costly; consequently, firms do not continuously review their prices. Price rigidity may thus stem from an absence of price review rather than from firms’ explicitly deciding not to change their prices due to menu costs. Actually, the price decision process can be simply formulated as:

Figure 1. Firm’s Price Review and Price Change Process

Unfortunately, separately identifying these processes from the observed data is not straightforward. The aim of the paper is therefore to propose an econometric approach enabling these two sources of price rigidity to be disentangled.

PAPER’S CONTRIBUTIONS

As noted, it is assumed that a firm’s decision process regarding price changes can be split into two stages. Firms first decide whether or not they should perform a price review. This decision can be time-dependent (reviewing prices on a regular basis, such as once a year, every January for example) or state-dependent (reviewing when faced with significant changes in their environment, such as sharp input price fluctuations). Once firms have implemented a price review, the second stage involves deciding whether to change (raise or lower) their prices or to maintain them. Obviously, if firms do not review their prices, the assumption is that they leave them unchanged (unless there is an automated price change rule, which is unlikely given the low inflation experienced since the 1990s).

The methodological contribution of the paper is twofold. First, we show that it is possible to (probabilistically) identify the respective roles of absence of price review and of absence of price change following a price review by estimating an Inflated Ordered Probit (IOP) model. Indeed, the above two stage price decision process fits this econometric framework very well. While the researcher does not witness this sequencing of decisions, but merely observes the price change or its absence, having a different set of explanatory variables for price review and for price change processes allows us to successfully disentangle these two processes.

We demonstrate the success of the strategy first via Monte-Carlo experiments. Then, we estimate an IOP model using firm-level data on prices and their determinants, mostly obtained from Banque de France business surveys. This allows us to provide what is, to the best of our knowledge, the first econometric evaluation of the respective contributions of (absence of) price reviews and of (absence of) price changes to the observed price rigidity.

Second, we show that the IOP framework makes it possible to circumvent the restrictions that would be embedded in a standard Ordered Probit (OP) model approach, and that could be particularly misleading in a price-review setup. In a standard OP price change model, finding that a variable affects the probability of a price change entails restrictions on the sign of its effect on the change. For instance, if a positive coefficient is found in January, prices will be predicted to be more likely to increase and less likely to decrease during that month. By contrast, in the IOP model, an increased probability of price review, say in January, can predict a greater likelihood of either a price increase or a price decrease in January.

The paper also provides empirical contributions regarding firms’ pricing decisions. We find that on average in a given quarter, there is only about a 30% chance of a firm conducting a price review, and that conditional on price review, the probability of a price change is 75%. Thus, a large fraction (about 90%) of no-price-change observations actually stems from an absence of price reviews. The theoretical literature has determined that information frictions can lead to a substantial effect of monetary policy shocks, in particular as compared to standard sticky price frictions. In this context, our results suggest the relevance of information costs and support the estimate of a relatively large effect of monetary policy on output and inflation.

FUTURE RESEARCH

While this paper provides an answer to the question of how far the infrequency of price reviews may explain price rigidity, it also raises further questions. In particular, in the current modelling, there is a unique equation explaining price reviews. However, while theoretical papers assume that firms’ pricereviewing decisions can be characterised as being either time-dependent or state-dependent, surveys show that firms may switch from time-dependent behaviour to state-dependent behaviour, and viceversa. Identifying the determinants of firms’ pricereviewing behaviours (time-dependent, statedependent or a “mix”) would provide interesting input to the understanding of pricing behaviours.

→ This article was issued in AMSE Newletter, Summer 2021.