Ewen Gallic & Gauthier Vermandel, 2020, European Economic Review, vol. 124(C).

RESEARCH PROGRAM

The intensity and frequency of weather shocks such as heat waves and droughts have been on an upward trend over the last 40 years. The economic damage caused internationally is not negligible (roughly US$25 billion in 2012), with economies relatively dependent on their agricultural sector particularly affected. Yet this growing source of macroeconomic fluctuations receives little attention in modern macroeconomic models.

PAPER’S CONTRIBUTIONS

Theoretical models in the macroeconomic literature focus mainly on the long-term effects of climate and neglect the short-term effects of the weather. In a context of climate change, however, policy makers are expected more frequently to face short-term adverse weather events with major implications (e.g., food insecurity, recessions, currency depreciation). So having a theoretical economic framework for the short-term effects is important. We propose one that is able to disentangle the contribution of weather shocks from alternative sources of business cycles and innovatively price it into consumption welfare losses. Most of the literature considers climate change solely as a trend, relegating the cost of weather fluctuations to a second-order issue. Our paper also contributes to the existing literature by investigating an unexplored facet of climate change: the increased variability of weather events.

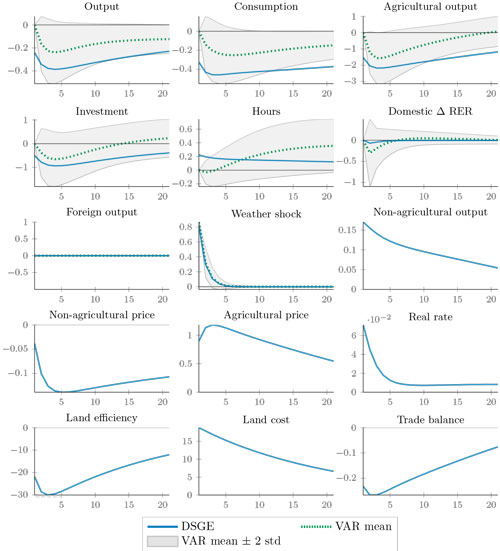

We follow a two-step strategy. First, we study the transmission mechanisms of a weather shock. We look at how a drought can cause economic fluctuations. We build a macro-level drought index that measures the productivity of agricultural land. This aggregate measure of the weather is included in a Vector AutoRegressive (VAR) model, alongside seven macroeconomic series from New Zealand. The impulse response functions analysis documents the transmission mechanism of weather shocks in a small open economy environment and provides a benchmark for a general equilibrium model.

In a second step, we enrich a Dynamic Stochastic General Equilibrium (DSGE) model with a weather dependent agricultural sector facing exogenous weather. Farmers are endowed with land with a time-varying productivity determined by both economic and weather conditions. The model is estimated through Bayesian techniques on the same sample as the VAR model to provide a complementary representation of the data. The estimated model provides a detailed understanding of how weather shocks propagate in the economy and yields several predictions on climate change from a general equilibrium perspective.

We get three main results. First, both models give a similar picture about the transmission of an adverse weather shock through a large and persistent contraction of agricultural production, accompanied by a decline in consumption, investment and a rise in hours worked. At an international level, a weather shock causes current account deficits and a depreciation of the domestic currency.

Second, we find that weather shocks play a non-trivial role in driving business cycles in New Zealand. On the one hand, the inclusion of weather-driven business cycles strikingly improves the statistical performance of the model. On the other, weather shocks drive an important fraction of the unconditional variance, in particular for GDP, consumption, and agricultural output. The consequence is that business cycles induced by weather shocks have a high welfare cost. We find that households would be willing to give up 0.19% of their unconditional consumption to avoid weather shocks, which is remarkably high with respect to other sources of disturbance in our model.

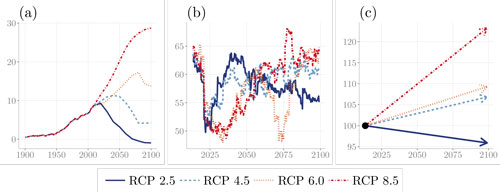

A third result is obtained from an original counterfactual analysis on climate change. We increase the volatility of weather shocks in accordance with IPCC (2014)’s climate change projections for 2100, and evaluate how these structural changes in the distribution of weather shocks affect macroeconomic volatility. We find that climate change critically increases the variability of key macroeconomic variables, such as GDP, agricultural output or the real exchange rate. The corollary of this structural change is an increase in the welfare cost of weather-driven business cycles, as high as 0.29% in the worst-case climate change scenario.

FUTURE RESEARCH

The analysis of weather-driven business cycles is a burgeoning research area in these times of concern over climate change. Applying our framework to developing countries could document the high vulnerability of their primary sectors to weather shocks. From a policymaker’s perspective, our framework could be used to determine the optimal monetary policy to mitigate the destabilizing effects of weather shocks for different scenarios of climate change. Fiscal policy, too, has a role to play in low-income countries, for instance by providing disaster payments considered as taxpayer-financed insurance schemes. Such disaster payments can make sense in the absence of well-functioning insurance markets.

Figure 1. System response to an estimated weather shock for the estimated DSGE and VAR model (when available).

Figure 2. Estimations of the increased standard error of the weather shock under four different climate scenarios. Note: The curves in panel (a) represent historical CO2 emissions/projections up to 2100 under each scenario. Estimated standard errors of projected precipitations for each representative concentration pathway are represented in panel (b). Their linear trends from 2013 to 2100 are depicted in panel (c).

© Photos by piyaset on Adobe Stock & Ewen Gallic

→ This article was issued in AMSE Newletter, Fall 2020.