Odran Bonnet, Guillaume Chapelle, Alain Trannoy & Étienne Wasmer, 2021, European Economic Review, 134 (C)

RESEARCH PROGRAM

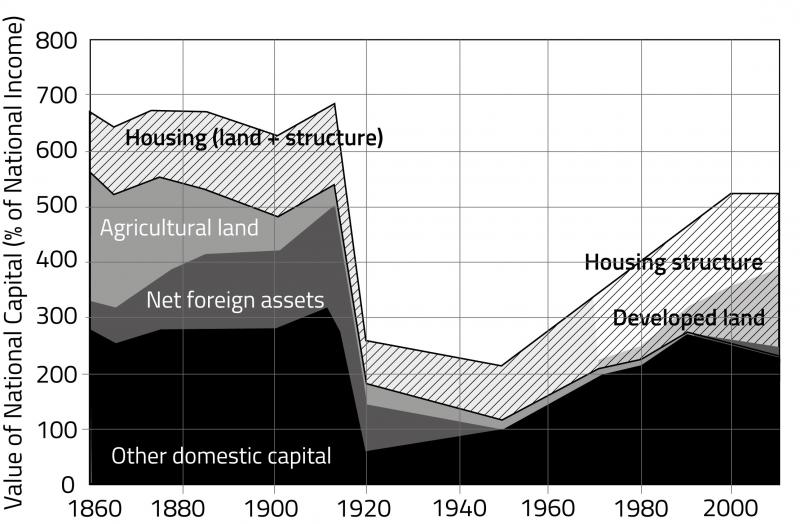

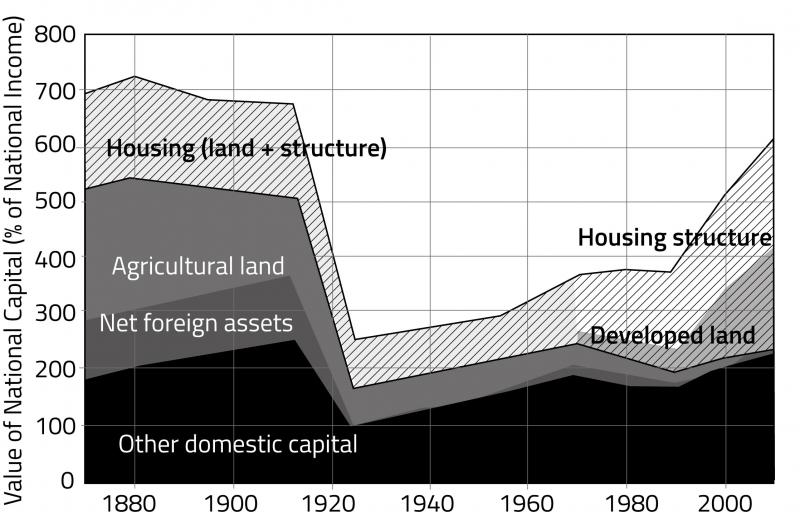

Uniform taxation of wealth is making a comeback as a response to rising public debt and increased inequality in most Western countries. This paper enters this debate from the striking observation that the housing component of national private wealth explains the spectacular rise of wealth relative to national income in several countries. Rising housing wealth is in major part due to the rise in land prices. Figure 1 represents the historical evolution of wealth-to-income ratios in France and the UK, using Piketty’s decomposition into housing, agricultural land, net foreign assets and other domestic assets.

The drop in total wealth at the beginning of the 20th century as compared to the 19th century was largely due to the secular decline in agricultural land and was accelerated by the decline in physical capital after WWI in France and the UK. If wealth levels rose again in the second half of the 20th century and partially regained their values of the previous century, it is because housing became a major component of wealth. Given the heterogeneity in sources of wealth and their diverging trends, applying one uniform wealth tax could be sub-optimal, especially considering the differences in supply elasticities. We assess the merits of differentiated taxation of wealth and compare land taxation, housing income taxation and physical capital taxes.

PAPER’S CONTRIBUTIONS

We extend a Judd-type model of capitalists and workers, an appropriate framework to study redistributive capital taxation, by introducing land, housing structures, housing consumption and the housing rental market. Actually, the Judd-Chamley framework represents a turning point in the literature discussing capital and wealth taxation issues. The literature has explored certain tax areas: e.g. taxes on labor and capital income, labor and dividends, or taxes on consumption, labor and pure rents. In this paper, we turn a new corner, exploring taxes on capital, land and housing and thus contributing to the literature by widening the scope. We perform this analysis both in first-best and second-best settings, under full commitment.

Figure 1. The role of land and housing in the secular variations in the wealth-to-income ratio. France and UK

A uniform land tax is theoretically enough to achieve the first best. We discuss cases and levels at which land taxes are feasible, and notably propose a formula for a property tax on land that will reach the social planner’s objective. This tax will compensate wageearners for having no property rights on capital and land. When land can actually be taxed at the firstbest level, taxing productive capital is not necessary. The quantitative and theoretical importance of a fixed factor, land, is reminiscent of the so-called Georgist view.

However, taxing land raises implementation issues and is seldom put into practice. Furthermore, land is difficult to distinguish from housing structures that are themselves elastic, and in order to reach the first best, static and dynamic distortions must be addressed. Therefore, we consider richer schemes that may and actually do preserve the first best. Indirect land taxation via the taxation of housing income is possible, but it cannot be implemented alone to reach the first best. A tax on rent therefore needs to be supplemented by i) a tax on land differentiated according to use of land - less on rented land and more on owner-occupied land - and ii) a specific subsidy on investments in rented structures. Without this specific combination of tax/subsidies, the first best cannot be achieved. However, based on the two distortions introduced by the tax on rent, one to land use and the other to the dynamics of the structures, our simulation reveals that the latter is much more critical quantitatively.

The upshot is that a rent tax supplemented by a structure subsidy does almost as well as a land tax in improving social welfare. The discussion illustrates the non-triviality of a tax scheme attempting to overcome the non-feasibility of an optimal uniform land tax. This set of instruments provides a rare example of the usefulness of the theory of the second best (Lipsey – Lancaster), combining three distortive instruments to mimic the impact of a non-distortive instrument.

Adopting a second-best Ramsey logic, where the social planner acts under the rationality constraints of agents, we next assume that a land tax is not feasible but that there is a rent tax. We then explore how the results in the steady state extend on dynamic convergent paths to the steady state. We obtain new results regarding the dynamics of capital taxes in the Judd economy with and without land, as well as results on the rent tax when it can be introduced.

FUTURE RESEARCH

A follow-up to this article is a book in French, written with Etienne Wasmer, to be published in January 2022 and possibly followed by an English translation.

→ This article was issued in AMSE Newletter, Winter 2021.